Members of the California State Legislature proposed a new annual wealth tax due at the same time as income tax payments. The tax rate is proposed as 0.4% of worldwide wealth over $30 million or $15 million for married filing separately.

The rule would require an annual valuation or statement of value, signed by the taxpayer, as of December 31 each year.

A second proposal was also introduced for a rate increase among earners with annual income above $1 million.

Read more details below.

Impacts for Nonresidents

There are provisions in the proposed legislation to include part-year residents and even a special apportionment formula when evaluating a new classification called a Wealth Tax Resident (WTR).

The WTR rules continue to attach wealth after a person has severed traditional residency using a denominator of 10 years; the numerator is years as a resident of California. The application of this provision will likely be challenged in court.

Application

There is a long list of items potentially subject to the wealth tax including:

- Publicly traded stocks, bonds, options, and futures

- Stock in an S Corporation and interest in a partnership

- Interest in a hedge fund or equity fund

- Cash deposits, including savings accounts

- Farm assets

- Art and collectibles

- Debts, including mortgages

- Real property held through any entity, including some trusts

- Other financial assets, including pension funds

Exclusions

Real property held directly by the taxpayer, such as a personal residence, is excluded. Similarly, mortgages on directly held real property are excluded.

Example

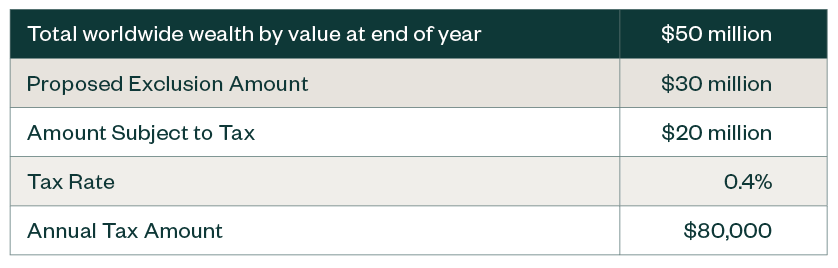

The table below represents the potential effect for married spouses filing jointly with $50 million in total assets as of December 31, 2020:

New Proposed Tax Brackets for High Income Taxpayers

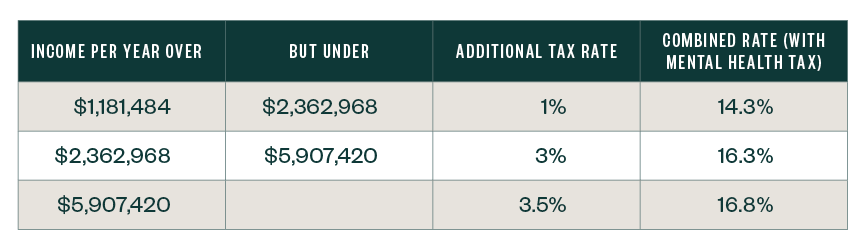

The second proposal is for a rate increase that applies to those with annual income above $1 million. The proposal would add three new rate brackets outlined in the table below:

These amounts are indexed to inflation so, if enacted, these amounts would continue to increase in future years.

Example

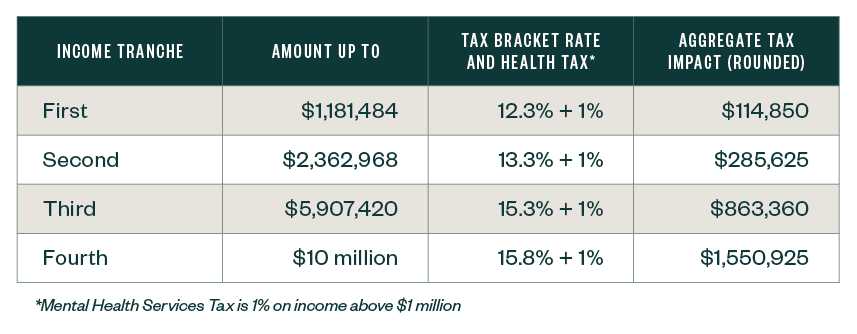

The table below represents the potential effect for married filing jointly taxpayers with $10 million in annual income:

Under the current tax law, the total tax on the same income would be $1,289,525.

The proposed legislation increases the tax burden by roughly $261,400 for a total of $1,550,925 on the same $10 million income amount.

This represents an approximately 20% tax increase, exclusive of the wealth tax increment.

Takeaways

It’s anticipated the proposed legislation won’t pass during the current session which expires on August 31, 2020.

California is currently facing over $60 billion in revenue deficit as a result of the pandemic. These measures, as well as many others, are the legislature’s response to this gaping budget divide.

When the new legislative session begins on December 7, 2020, these measures are likely to reappear as bills in the new session for passage if state tax revenues continue to fall below the state’s budget needs.

It’s important to note, the proposed legislation wouldn’t be ballot measures. The rate increases could be carried by the legislature and executed with the governor’s signature.

If both the increased tax brackets measure and the proposed wealth tax pass, the potential increase for a client with $50 million worldwide worth and $10 million in annual income would be approximately $341,000 per year.

We’re Here to Help

If you have any questions about the proposed legislation, please contact your Moss Adams professional.